Performance Commentary

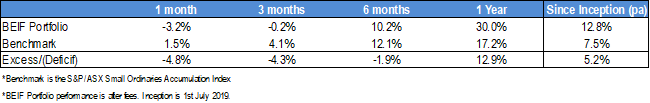

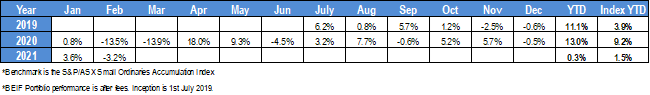

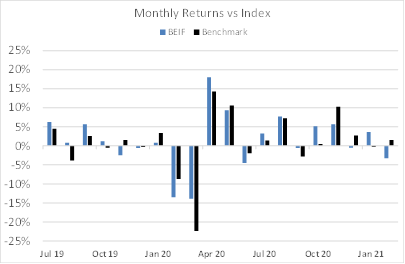

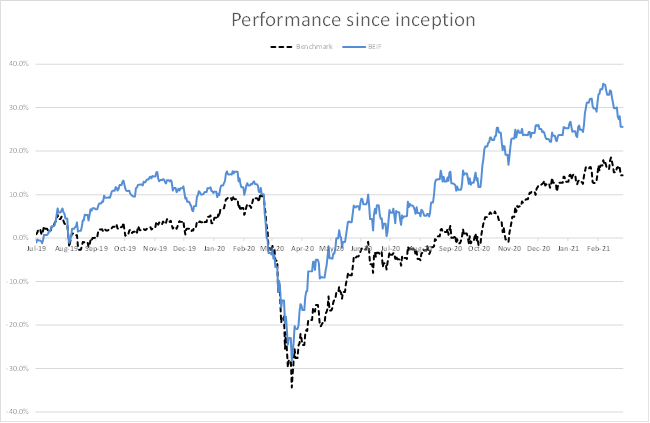

In the month of February, the portfolio lost 3.6%, underperforming the benchmark S&P/ASX Small Ordinaries Accumulation Index by 4.8%.

Tech shares were very volatile, initially as Yellen, the US Treasury Secretary, announced the possibility of stimulus. This was followed by a rising US 10-year bond yield and expectations of higher inflation.

The corresponding selldown in Australian small cap high growth tech stocks impacted the portfolio, with Netwealth (NWL), and HUB24 (HUB) both showing large declines.

Investors appear to be favouring the “opening up” trade as the vaccine rollout continues and participants expect large fiscal and monetary stimulus to carry into what is a fragile economy. Stocks such as Baby Bunting (BBN) and Bega Cheese (BGA) were some of our strongest performers. However, travel stocks such as Sealink (SLK), Webjet (WEB), and Flight Centre (FLT) were some of the strongest performers on the market.

Valuations in the market reflect an optimism that the economy will return to pre-covid levels without issue. Pockets of what we considered to be reasonable value remain, however, investors in the market are still chasing growth as interest rates continue to be low.

Our relative performance is likely to be soft as commodity stocks are favoured in a period of inflation expectations and technology is the likely funding source give the PE expansion in this sector over the last year. That being said, we remain confident that the underlying trends in our investments will carry forward.

Investment Objectives

We aim to achieve superior returns to the ASX Small Ordinaries Accumulation Index by investing in high growth companies. Our investment process incorporates environmental and social factors in addition to achieving our returns.

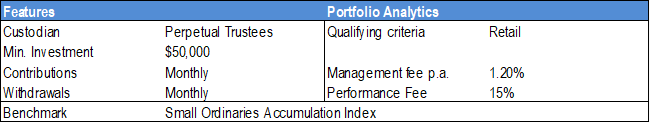

Portfolio Characteristics