Performance Commentary

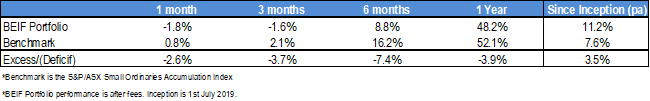

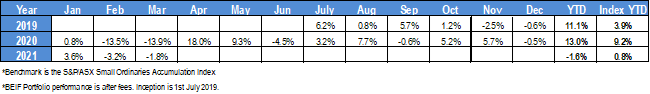

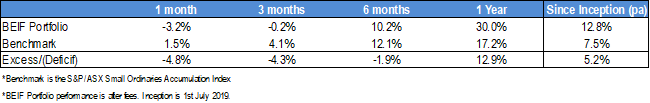

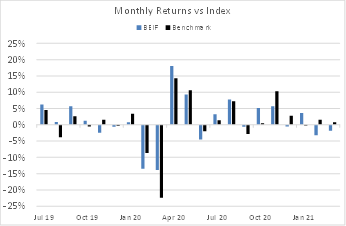

In the month of March, the portfolio fell 1.8%, underperforming the benchmark S&P/ASX Small Ordinaries Accumulation Index by 2.6%.

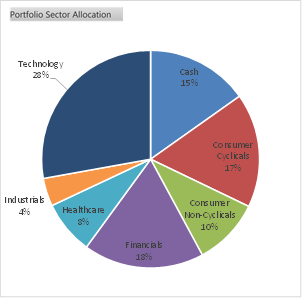

Global markets rallied in March, with the US seemingly shaking off rising bond prices. However, Australian technology stocks, which this portfolio is exposed to, sold off significantly, in particular Fintech stocks such as Praemium (PPS), Netwealth (NWL) and Hub24 (HUB).

The corresponding selldown in Australian small cap high growth tech stocks impacted the portfolio, with Netwealth (NWL), and HUB24 (HUB) both showing declines.

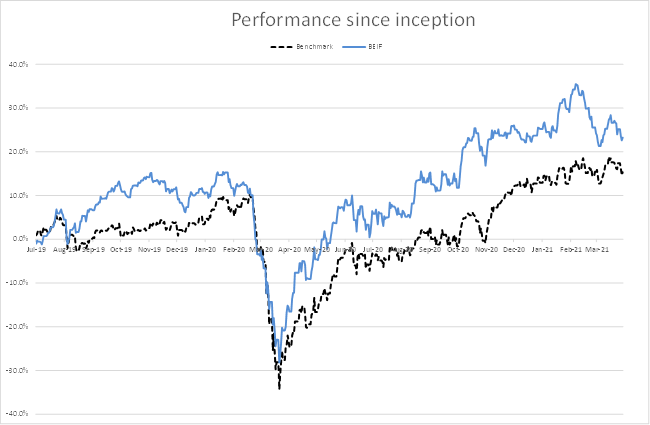

In the full year since the major correction, our portfolio has gained 48.2% slightly behind the index. However, our portfolio was not sold down as significantly as the index during the crisis, highlighting our conservative and diversified portfolio.

Our relative performance is likely to be soft as commodity stocks are favoured in a period of inflation expectations and technology is the likely funding source given the price-to-equity expansion in this sector over the last year. That being said, we remain confident that the underlying trends in our investments will carry forward.

Investment Objectives

We aim to achieve superior returns to the ASX Small Ordinaries Accumulation Index by investing in high growth companies. Our investment process incorporates environmental and social factors in addition to achieving our returns.

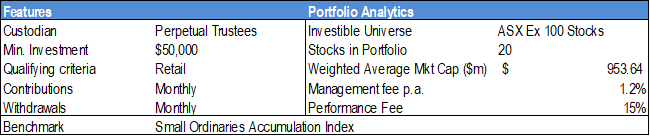

Portfolio Characteristics