Performance Commentary

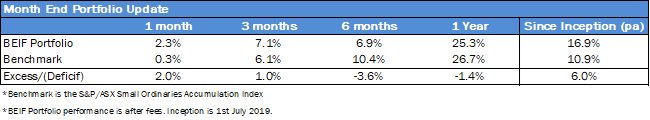

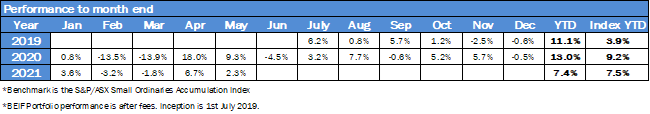

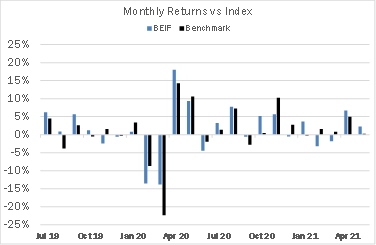

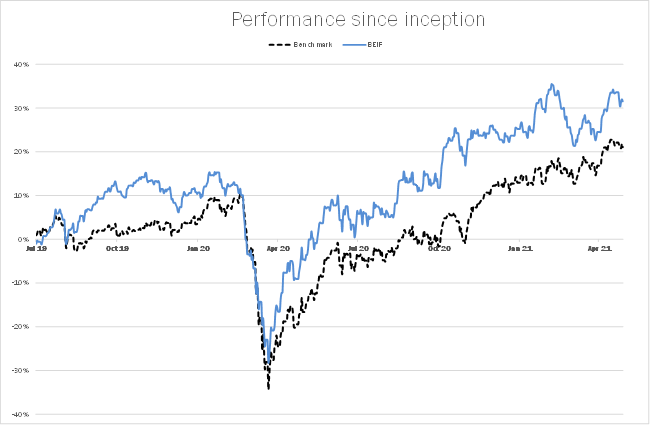

In the month of May, the portfolio rose 2.3%, outperforming the benchmark S&P/ASX Small Ordinaries Accumulation Index by 2.0%.

Inflation concerns worried global markets, after the US reported a higher than expected CPI print. Markets were quite volatile initially but stabilised towards the end of the month. However, the persistent trend of higher wages continues globally as economies deal with structural unemployment and the transitioning of workers to other areas of the economy.

The top performer in the fund was a financial technology business Praemium (PPS) where there is speculation about a change of ownership after the departure of the CEO and internal review.

We maintain our belief that interest rates will remain low in Australia until at least 2024. This gives a runway for higher valuations and we remain committed to high growth companies.

Investment Objectives

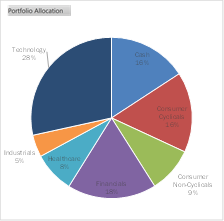

We aim to achieve superior returns to the ASX Small Ordinaries Accumulation Index by investing in high growth companies. Our investment process incorporates environmental and social factors in addition to achieving our returns.

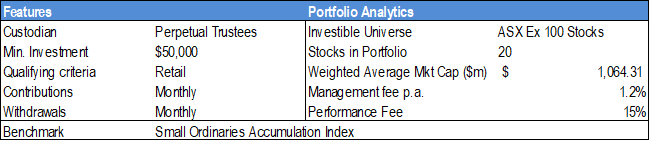

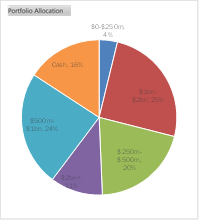

Portfolio Characteristics