Performance Commentary

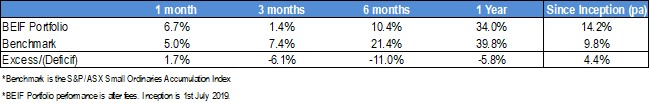

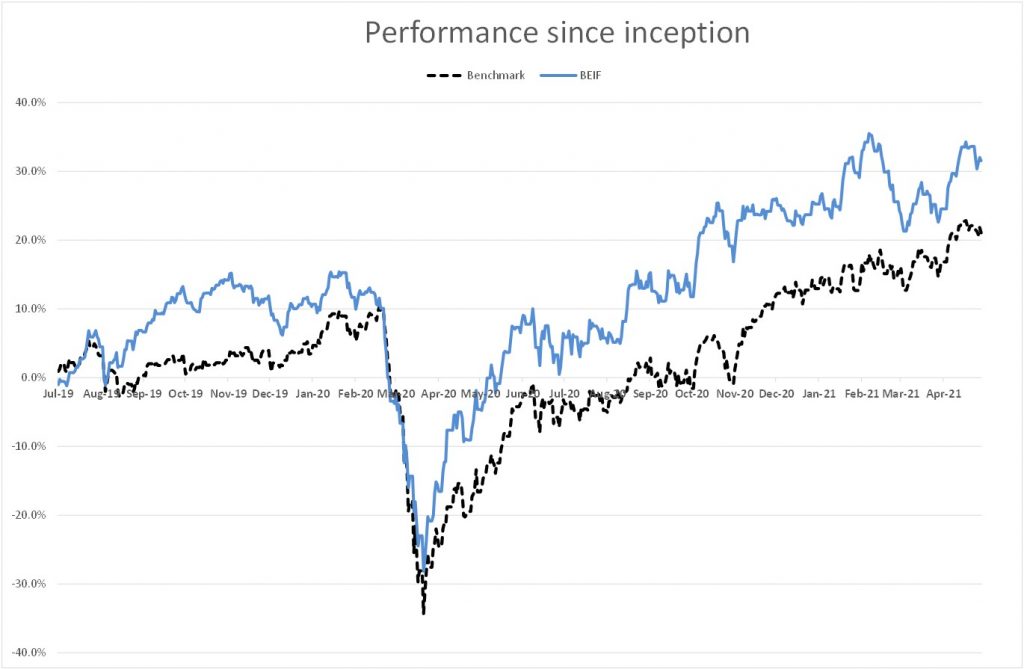

In the month of April, the portfolio rebounded 6.7%, outperforming the benchmark S&P/ASX Small Ordinaries Accumulation Index by 1.7%.

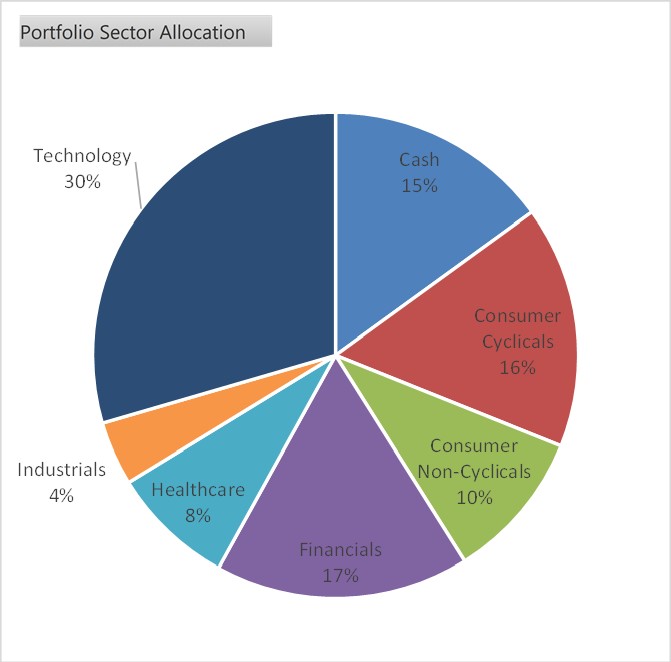

Australian shares rallied, but lagged global markets. In the S&P/ASX Small Ordinaries Index, technology was one of the best sectors, given the declining bond yields making growth stocks more attractive. With our larger allocation to this sector, the portfolio saw sharp rebounds in names such as Netwealth (NWL), and HUB24 (HUB).

The other part of the index that rallied was mining. Our portfolio does not have exposure to this part of the index, but mining had a very strong month as commodity prices remain elevated. Continued worries about inflation are likely to keep commodity prices high and may take some gloss off our relative performance as this thematic continues.

That being said, we remain confident that the underlying trends in our investments will carry forward and happy with the continued migration of physical retail to online.

Investment Objectives

We aim to achieve superior returns to the ASX Small Ordinaries Accumulation Index by investing in high growth companies. Our investment process incorporates environmental and social factors in addition to achieving our returns.

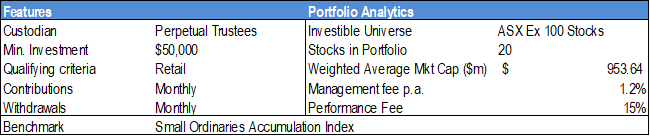

Portfolio Characteristics