June 2021 Performance Commentary

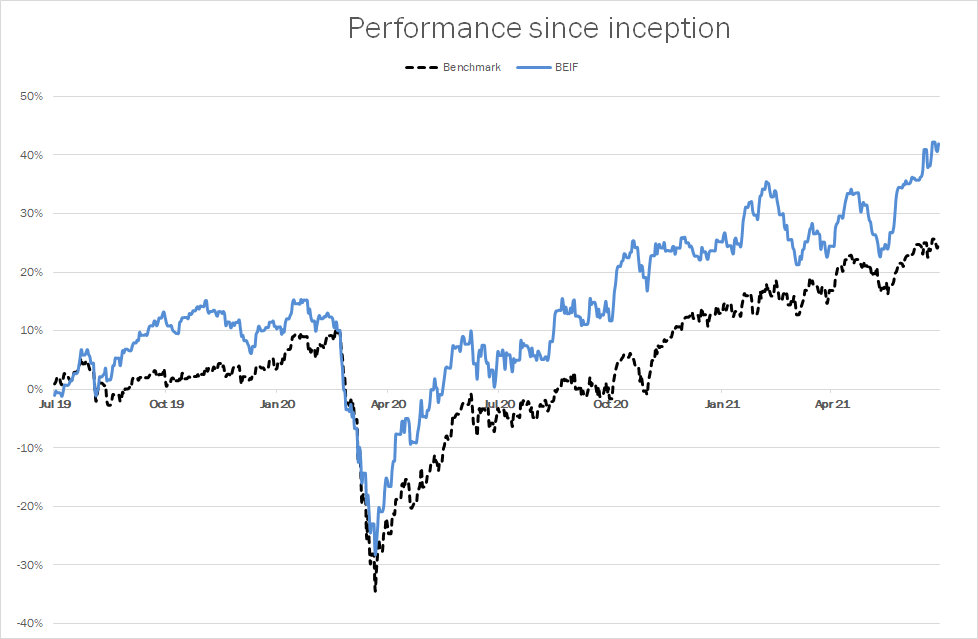

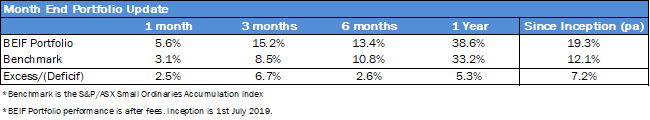

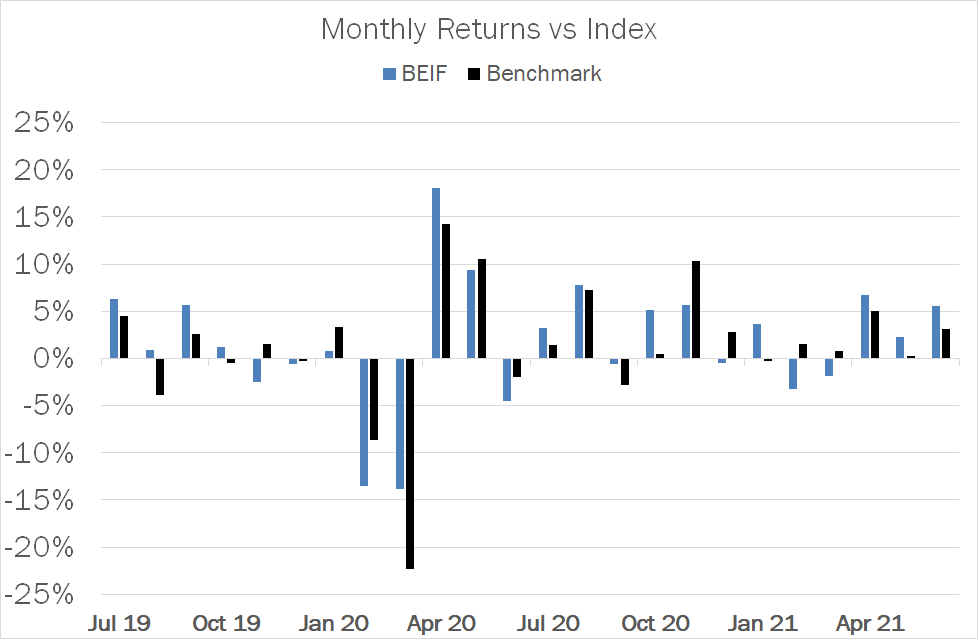

In the month of June, the portfolio rose 5.6%, outperforming the benchmark S&P/ASX Small Ordinaries Accumulation Index by 3.1%. For the financial year the portfolio increased 38.6%, outperforming the benchmark by 5.3%.

June was marked by the FOMC who announced a stance that would lead to more hawkish monetary policy than was expected. This would lead to increases of interest rates sooner than expected and higher interest rates generally means lower stock valuations. The negative reaction was quicky reversed as growth levels remain strong and the belief that the current spike in inflation is only transitory in nature.

Australian small cap stocks were generally higher June. Fintech stocks were very strong again, with gains in companies like Netwealth (NWL), HUB24 (HUB) and Audinate (AD8). At the other end of the spectrum, Baby Bunting (BBN) and other retail stocks suffered as rolling lockdowns plagued Australia in June.

Investment Objectives

We aim to achieve superior returns to the ASX Small Ordinaries Accumulation Index by investing in high growth companies. Our investment process incorporates environmental and social factors in addition to achieving our returns.

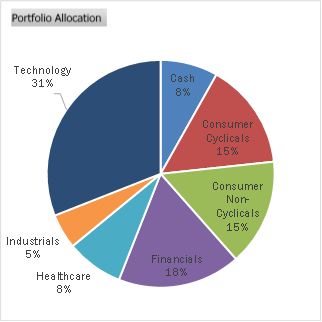

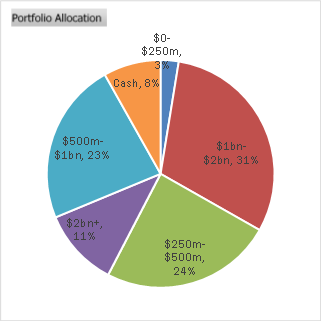

Portfolio Performance and Allocation