August 2021 Performance Commentary

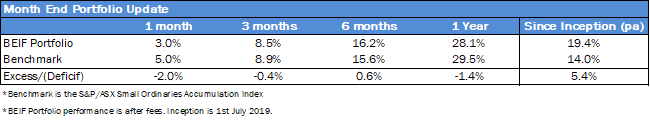

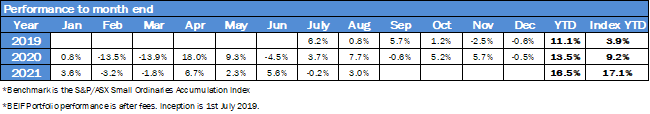

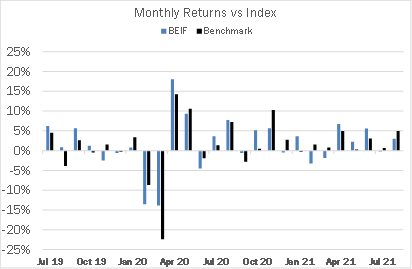

In the month of August, the portfolio rose 3%, but underperformed the benchmark S&P/ASX Small Ordinaries Accumulation Index by 2.0%. Reporting season saw many companies report a challenging 12 months and a clouded future amidst covid lockdowns and uncertain demand.

In macro news, the Chinese government increased regulations on the internet sector causing share prices of their largest technology stocks to plummet. US Federal reserve chairman spoke at the Jackson Hole convention indicating the Federal reserve would be reducing their stimulus plans, but it was inline with market expectations. Market expectations vary, but we do not expect US interest rate hikes for 2022 and 2023 which underpins the present equity prices. While Dicker Data (DDR) rose for the month, the founder David Dicker sold 2.74m shares (of a ~60m shareholding) causing the price to fall from its mid-month high. HUB24 (HUB), MNF Group (MNF) and Praemium (PPS) were the top contributors to the portfolio. Bapcor (BAP), Baby Bunting (BBN) and Integral Diagnositcs (IDX) were the top detractors.

Investment Exposures

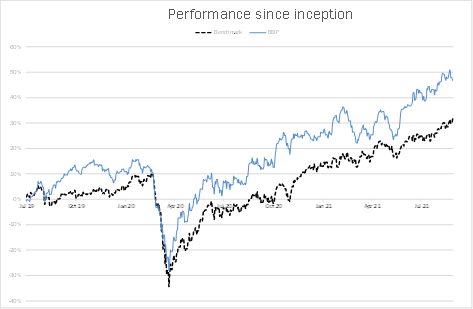

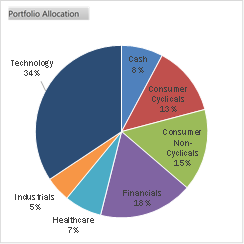

We aim to achieve superior returns to the ASX Small Ordinaries Accumulation Index. We are achieving this with our large exposure to technology companies which have significant global growth prospects, benefit from the disintermediation of financial services or hold large established positions within the Australian marketplace.

Portfolio Allocation

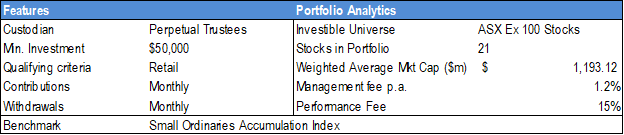

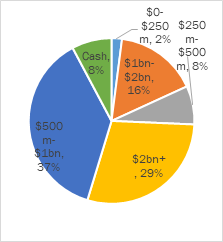

Portfolio Characteristics